#Pure Earnings Play

- Getting the data and writing the function

- Top sectors and stocks from results

- Beautiful plots to visualize the results

- Quick review

- How to improve the simple strategy

You often hear two things when watching or reading financial news. One is earnings season, and another is quantitative trading. Most people prefer to manage their own money and pick the companies their most familiar with when making trading decisions. I’m going to integrate the two to talk about the performance of a simple earnings trade strategy across the NASDAQ and how it compares against a basket of popular stocks. I wanted to compare it to a group of popular names from the NASDAQ to simulate the “go-to” names for the average mom-and-pop investor. These popular names will include Facebook, Apple, Amazon, Netflix, Google, and many more to see if these Wall Street darlings are also the best ones to trade during earnings. After all, if these companies are doing so well then their earning results should reflect that.

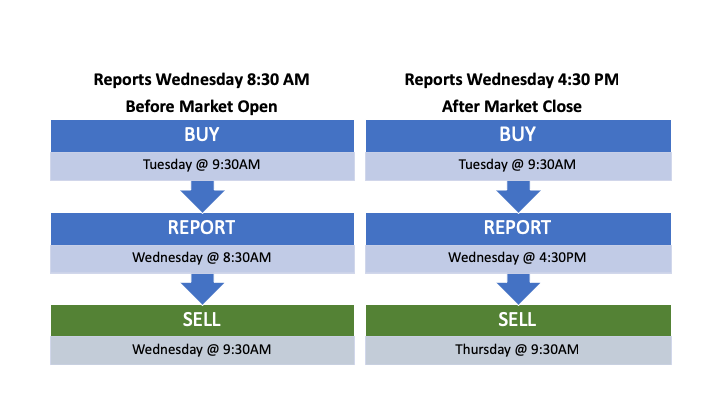

###The Process The trading strategy is kept simple to illustrate the common approach to trade earnings. The strategy will buy the stock at the market open one day prior to the earnings release date, and if the company reports BEFORE the market open, then we will sell at the market open. If the company reports AFTER market close, then we will sell it the following day at the market open. See below to see how the trades are triggered.

We are going to use this strategy and scale it out to each stock in the NASDAQ with a market cap over $5Billion. This is when the computers take over because we want to run this across thousands of different stocks and then run additional scripts on the results. A great trader usually focuses on a core set of stocks, whereas a computer can keep track of tens of thousands at a fraction of the time.

###The Data All of our stock data (with exception of earnings dates) comes from an R package called “tidyquant” that uses yahoo, quandl, alphavantage, bloomberg, etc. for pricing data. First, we gather the NASDAQ exchange data and drop all stocks that do not have a Billion $ market cap, then filter out all companies that are under a $5 Billion market cap. After, we will map a pricing function to all stocks that passed our market cap screening to obtain the historic pricing data since the start of 2016. Finally, I will drop any rows that may contain NA values. After filtering through the NASDAQ, there are 282 stocks remaining that meet our criteria. I’ll also need to get all of the quarterly earnings dates for each stock during our specified time period. I will web scrape the data from a reputable source online in order for me to get accurate historic earnings data for each stock. I am saving $$$ by getting the data this way. Let’s look at the results through a variety of different visualizations, starting with a Lollipop chart to illustrate the top performing sectors by overall total returns.

###Top Sectors

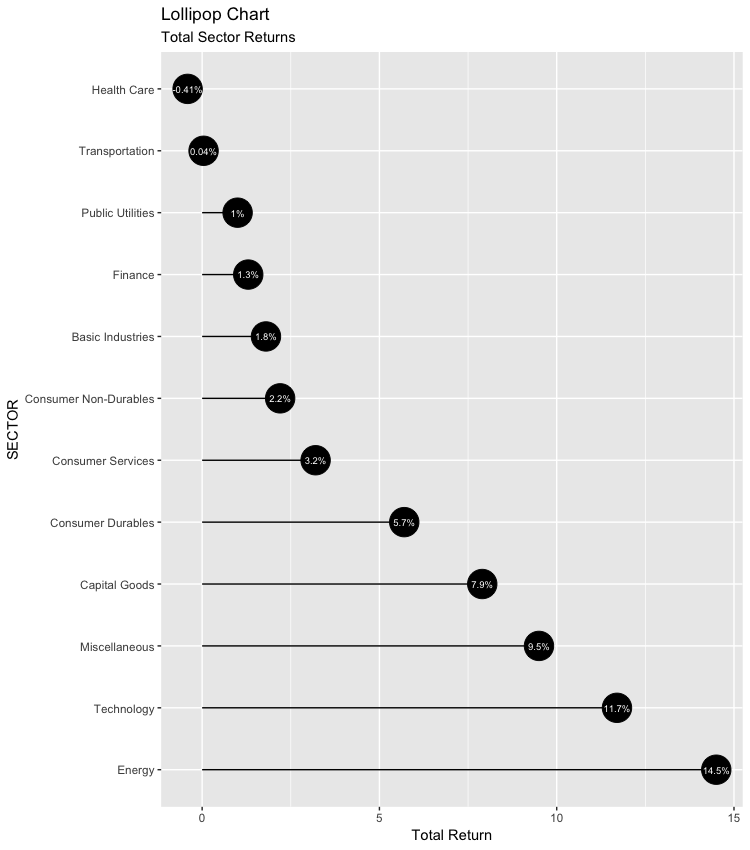

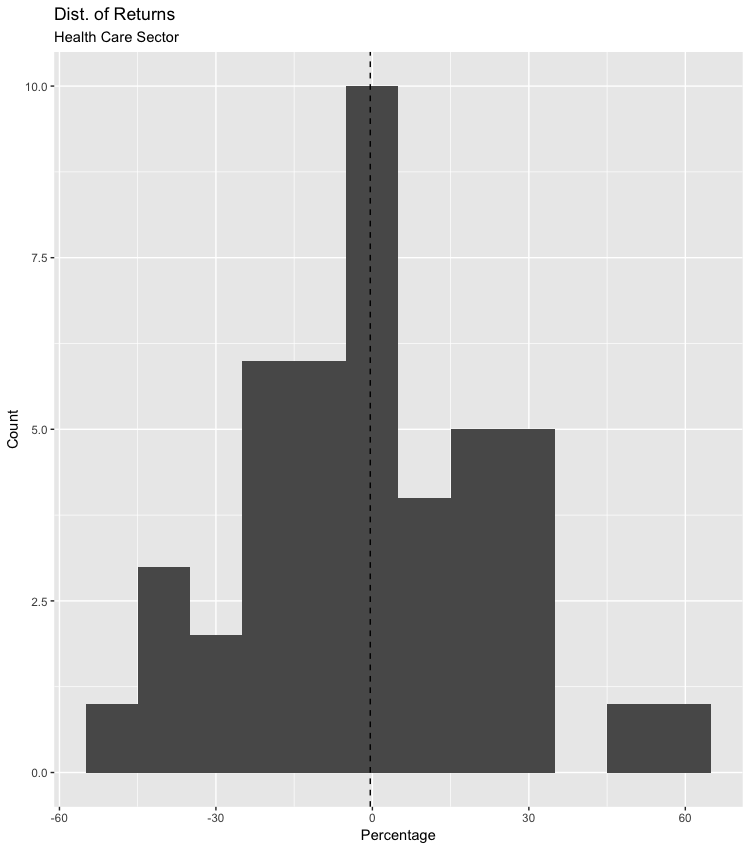

Being that we are backtesting the NASDAQ, I was quite surprised to see only one sector at a loss and the Energy coming out on top. After looking a little deeper, I found that only two stocks were responsible for the Energy Sector coming out on top. If additional energy companies would have made it through our initial Market Cap screening, then most likely Technology would have taken the #1 spot. Since this was such a simple strategy, I was very surprised to see only one sector at a loss. To see if only a few companies were responsible for the overall loss or if the losses were evenly spread out through the sector, we view the distribution on a histogram. After taking a quick look, it is clear to see that the returns are pretty normally distributed. Below is a table that lists each Sector by total overall returns and the number of companies in each sector.

## # A tibble: 12 x 3

## SECTOR OVERALL.RTRN Companies

## <chr> <dbl> <dbl>

## 1 Energy 14.5 2

## 2 Technology 11.7 92

## 3 Miscellaneous 9.5 12

## 4 Capital Goods 7.9 15

## 5 Consumer Durables 5.7 2

## 6 Consumer Services 3.2 60

## 7 Consumer Non-Durables 2.2 10

## 8 Basic Industries 1.8 3

## 9 Finance 1.3 30

## 10 Public Utilities 1 4

## 11 Transportation 0.04 8

## 12 Health Care -0.41 44###Histogram: Returns for each company in the Health sector.

###Top Stocks

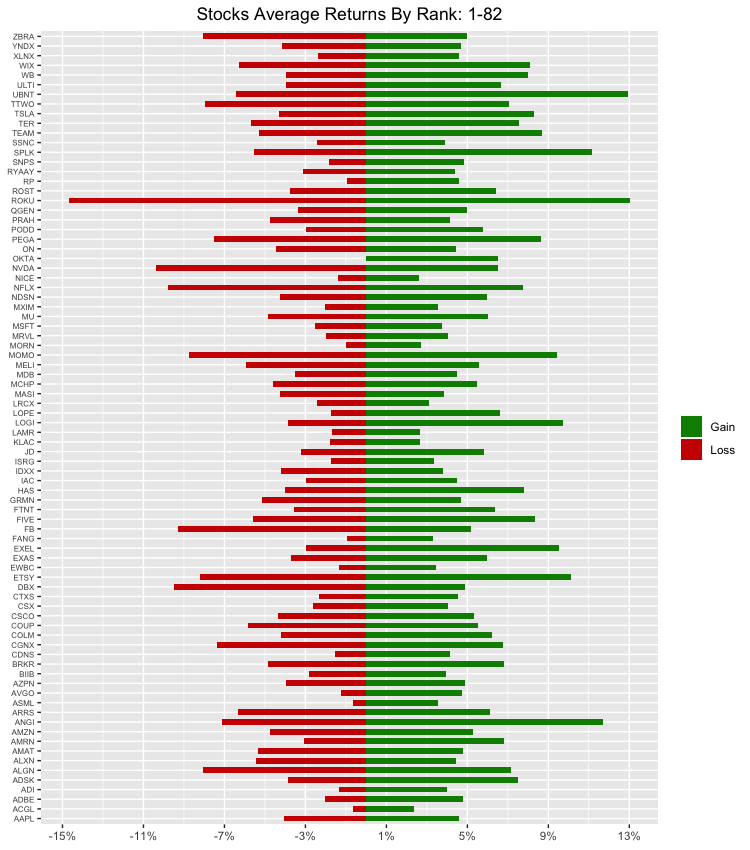

Now, let’s take a look at the Top 40 performing stocks by total return using the same Lollipop chart. Do you notice any of the big names, like Amazon or Apple? I’ll also print a table showing the top 100 stocks by overall total return, number of trades, and the sector it is in.

## # A tibble: 282 x 4

## Symbol OVERALL.RTRN `# of Trades` SECTOR

## <chr> <dbl> <dbl> <chr>

## 1 ETSY 85.0 12 Miscellaneous

## 2 LOPE 77.4 13 Consumer Services

## 3 LOGI 72.0 13 Technology

## 4 UBNT 71.5 13 Technology

## 5 SPLK 67.1 12 Technology

## 6 PODD 60.5 12 Health Care

## 7 ANGI 58.0 13 Consumer Services

## 8 EXEL 48.7 13 Health Care

## 9 WB 48.4 12 Technology

## 10 TTWO 46.8 13 Technology

## 11 OKTA 45.7 7 Technology

## 12 FIVE 44.3 12 Consumer Services

## 13 RP 43.9 12 Technology

## 14 YNDX 43.3 13 Technology

## 15 BRKR 41.9 13 Capital Goods

## 16 GRMN 41.1 13 Capital Goods

## 17 COLM 39.1 13 Consumer Non-Durables

## 18 ZBRA 39.0 13 Technology

## 19 ASML 37.5 13 Technology

## 20 CDNS 36.6 13 Technology

## 21 LRCX 34.7 13 Technology

## 22 TEAM 34.2 13 Technology

## 23 NVDA 34.0 13 Technology

## 24 ULTI 33.3 13 Technology

## 25 ADSK 33.3 12 Technology

## 26 AVGO 33.0 12 Technology

## 27 TSLA 32.1 13 Capital Goods

## 28 XLNX 31.8 13 Technology

## 29 SSNC 31.6 13 Technology

## 30 PEGA 31.6 13 Technology

## 31 CGNX 31.4 13 Capital Goods

## 32 MCHP 30.8 13 Technology

## 33 ADI 30.7 13 Technology

## 34 NFLX 30.5 13 Consumer Services

## 35 EWBC 30.4 13 Finance

## 36 ADBE 30.2 12 Technology

## 37 MASI 30.2 12 Health Care

## 38 MXIM 29.7 13 Technology

## 39 SNPS 29.5 13 Technology

## 40 EXAS 29.4 13 Health Care

## 41 IAC 28.6 13 Consumer Services

## 42 ALXN 28.2 13 Health Care

## 43 NDSN 26.6 13 Capital Goods

## 44 QGEN 26.5 12 Health Care

## 45 IDXX 25.4 13 Health Care

## 46 MRVL 24.5 12 Technology

## 47 FB 24.0 13 Technology

## 48 MSFT 23.7 13 Technology

## 49 ISRG 23.4 13 Health Care

## 50 PRAH 23.2 12 Health Care

## 51 FTNT 23.2 13 Technology

## 52 ROKU 22.8 6 Consumer Services

## 53 MOMO 22.3 12 Technology

## 54 AMRN 22.2 12 Health Care

## 55 ON 22.1 13 Technology

## 56 AMAT 21.8 13 Technology

## 57 ACGL 21.6 13 Finance

## 58 COUP 21.5 8 Technology

## 59 MELI 21.1 12 Miscellaneous

## 60 CSCO 20.9 13 Technology

## 61 MORN 20.3 13 Finance

## 62 NICE 19.5 13 Technology

## 63 RYAAY 19.5 13 Transportation

## 64 AZPN 19.4 13 Technology

## 65 CSX 19.2 13 Transportation

## 66 WIX 19 13 Technology

## 67 HAS 18.8 13 Consumer Non-Durables

## 68 TER 18.7 13 Capital Goods

## 69 AMZN 18.6 13 Consumer Services

## 70 MU 18.1 12 Technology

## 71 CTXS 17.7 13 Technology

## 72 FANG 17.7 13 Energy

## 73 LAMR 17.4 13 Consumer Services

## 74 BIIB 17.3 13 Health Care

## 75 ARRS 17.3 13 Technology

## 76 KLAC 16.7 13 Capital Goods

## 77 ALGN 16.7 13 Health Care

## 78 AAPL 16.6 13 Technology

## 79 ROST 16 12 Consumer Services

## 80 JD 15.7 12 Consumer Services

## 81 VRSN 14.9 13 Technology

## 82 TRMB 14.8 13 Capital Goods

## 83 JBHT 14.7 13 Transportation

## 84 MDB 14.4 5 Technology

## 85 MYL 13.6 12 Health Care

## 86 HTHT 13.4 12 Consumer Services

## 87 STLD 13.2 13 Basic Industries

## 88 PFPT 13.0 13 Technology

## 89 ZION 12.7 13 Finance

## 90 PYPL 12.7 13 Miscellaneous

## 91 ORLY 12.4 13 Consumer Services

## 92 BIDU 12.3 13 Technology

## 93 DXCM 12.2 13 Health Care

## 94 DISCB 12.1 12 Consumer Services

## 95 AKAM 11.4 13 Miscellaneous

## 96 TMUS 11.4 13 Public Utilities

## 97 WWD 11.4 13 Energy

## 98 WDC 11.2 13 Technology

## 99 LBRDK 11.1 9 Consumer Services

## 100 LBRDA 11.1 10 Consumer Services

## # … with 182 more rows###Average Gains / Losses for Each Stock Traded

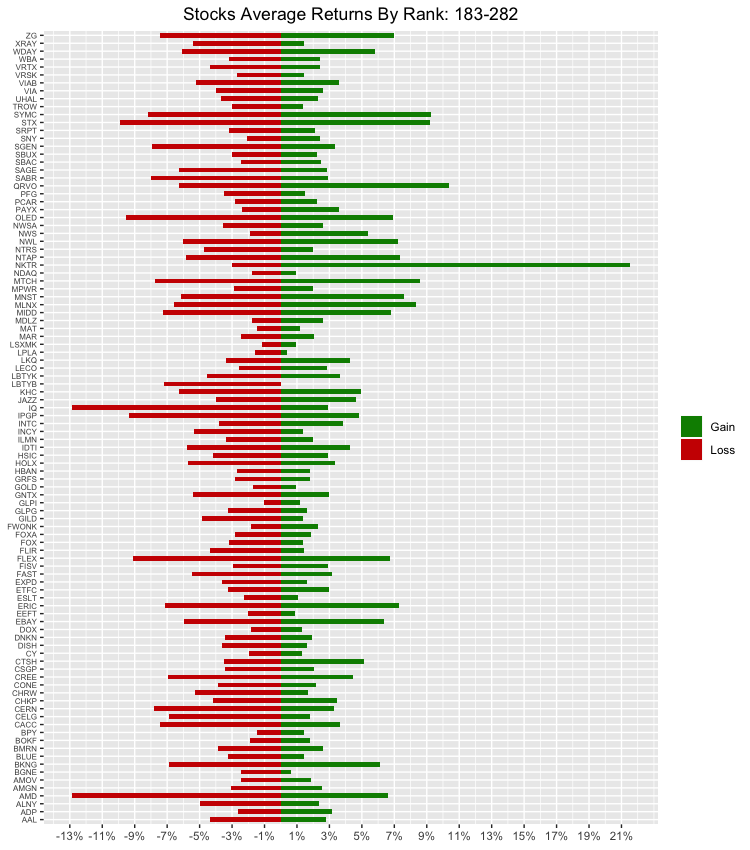

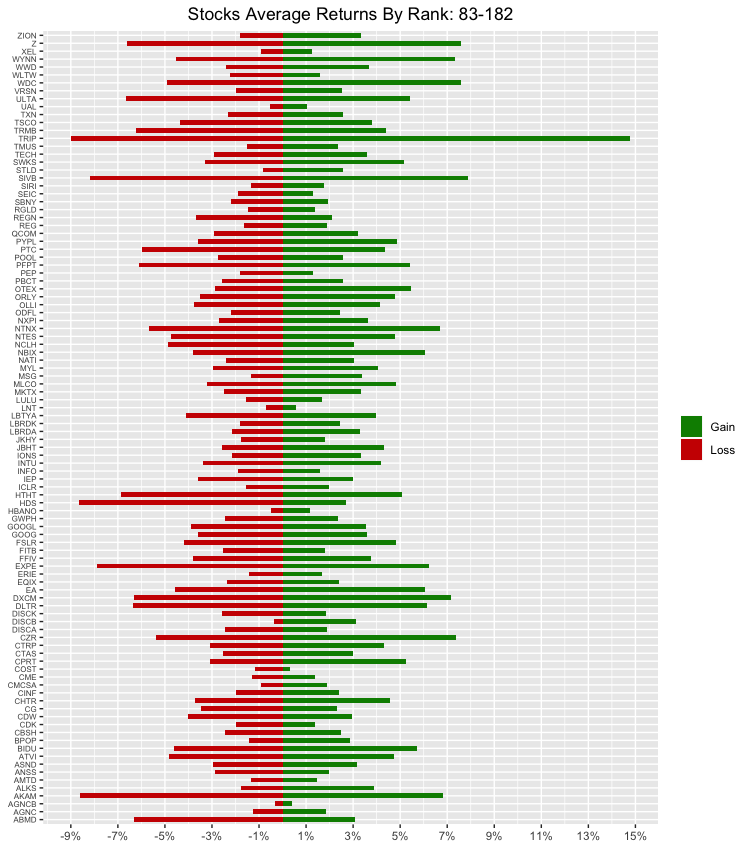

We have over 280+ stocks with each earnings trade since 2016. It would not be a good-looking chart if we threw all of those on one axis, or even over a layer of different grids. I think a diverging bar graph would suit this nicely. We can put 100 stocks on a graph and easily see the average gains and losses for each stock. We will start from the last ranked stocks by return and work our way down, so the first chart shows the top 183-282 stocks by return, and their respective gains and losses.

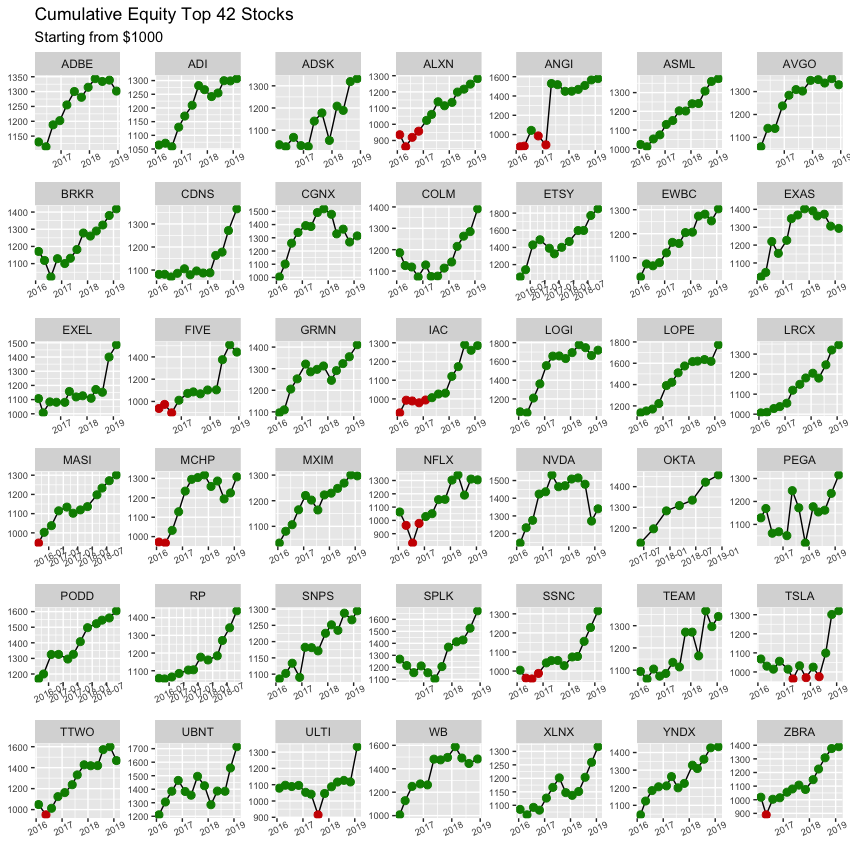

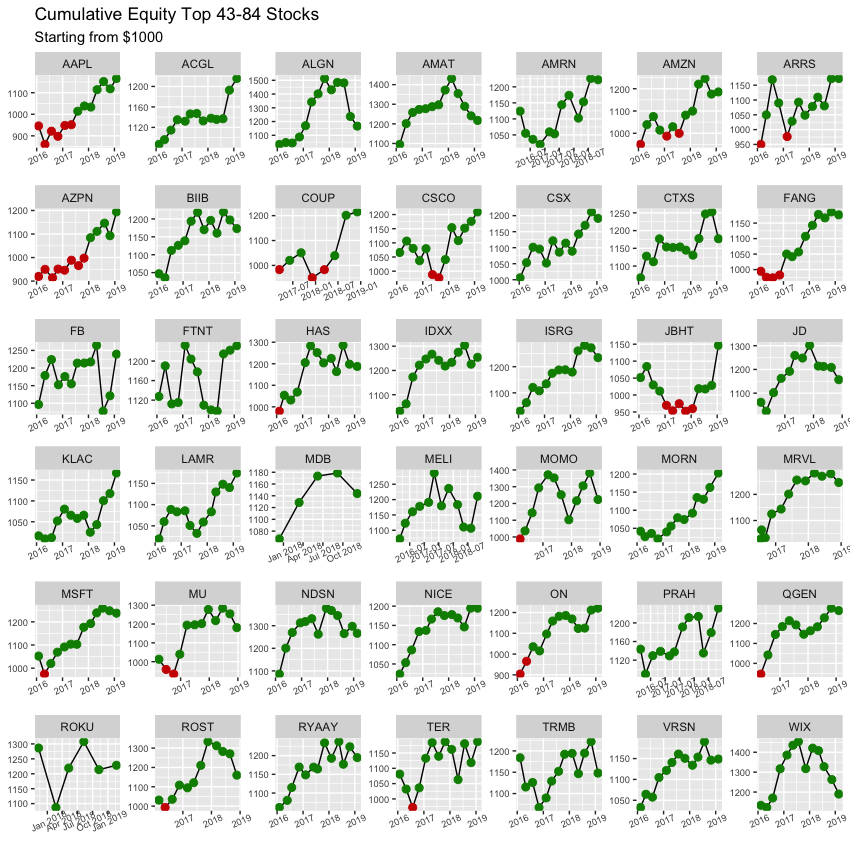

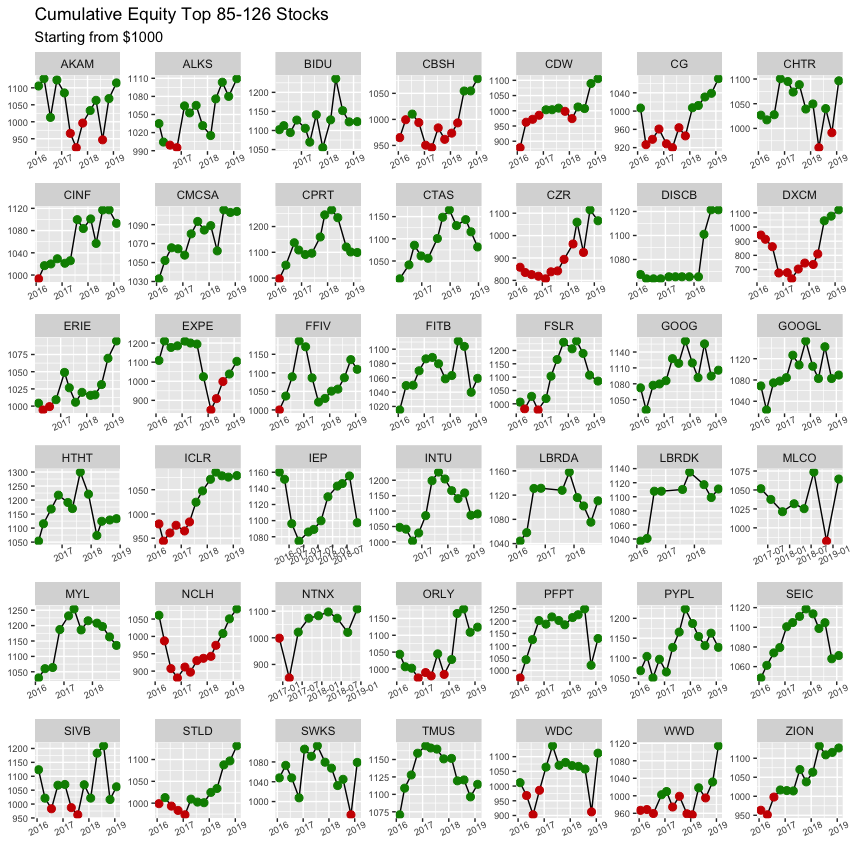

###Cumulative Changes in Each Stock Traded

Now, we can create a few grids to illustrate the cumulative change for the total capital over the backtesting period if we were to allocate $1000 DOLLARS into each stock. If the bullet is GREEN, then that means we are at a profit and above our initial capital of $1000 DOLLARS, and if it’s RED then it means we are at a loss. Let us look at the top 126 stocks by return over three different grids.

###Surprise, Surprise

Were you expecting any of the above results? Did it surprise you to see the Energy sector come out on top or the lack of popular household stocks in the Top 10? I was pretty surprised to see ETSY come out on top as #1 for total returns at 85%, while EBAY (similar business model) came in at #192/282 for a total return of -3.53%. What about the overall return for the rest of the portfolio?

###Overall Returns

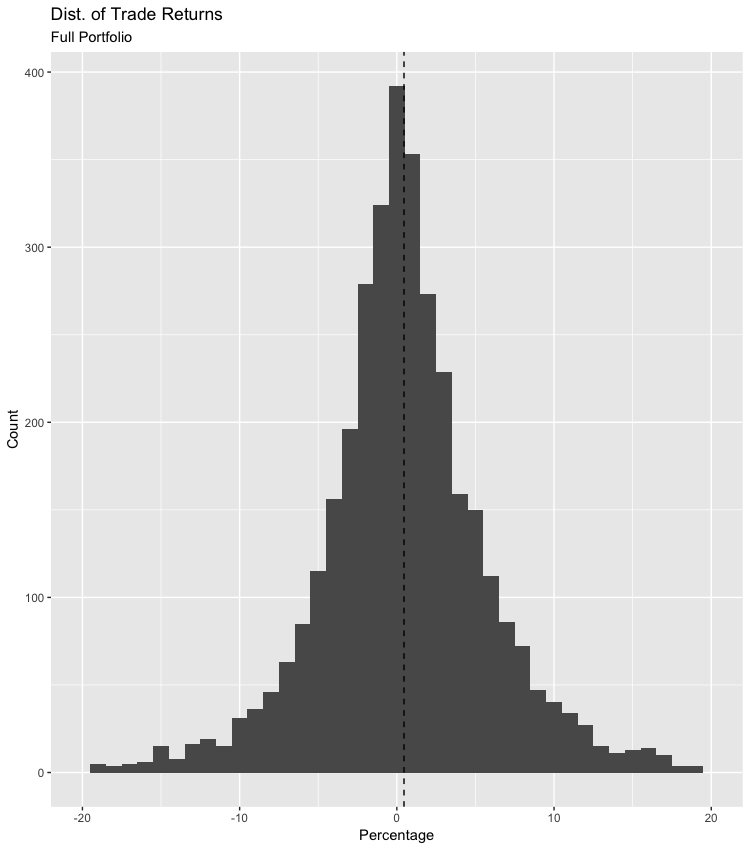

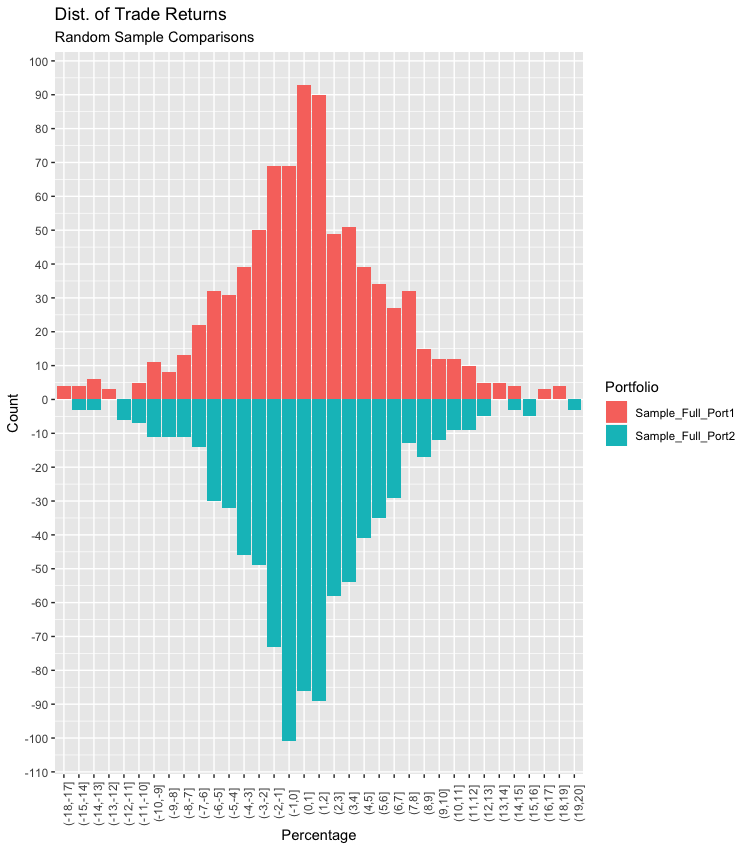

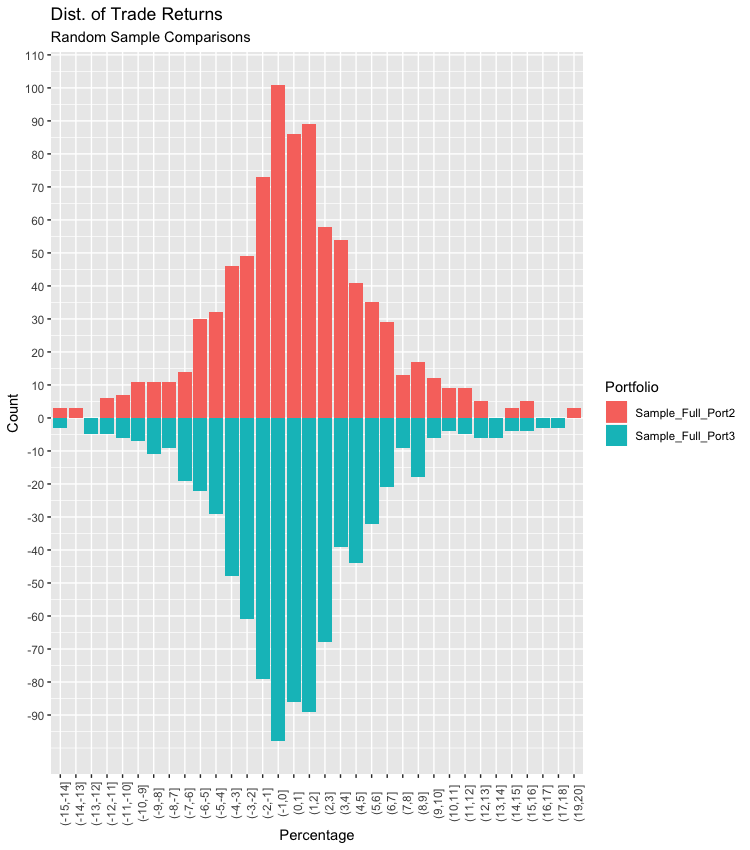

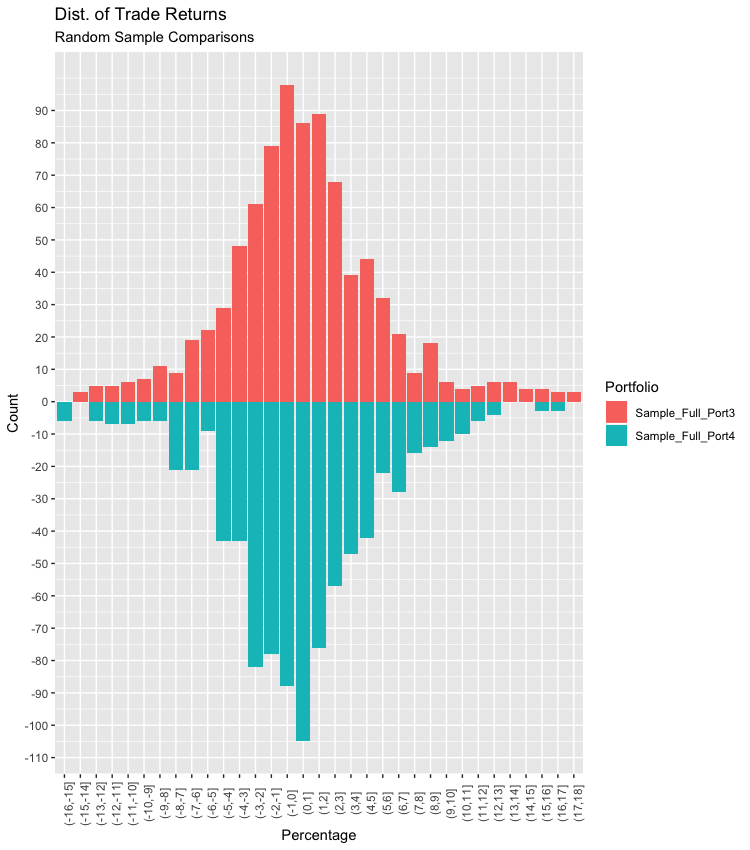

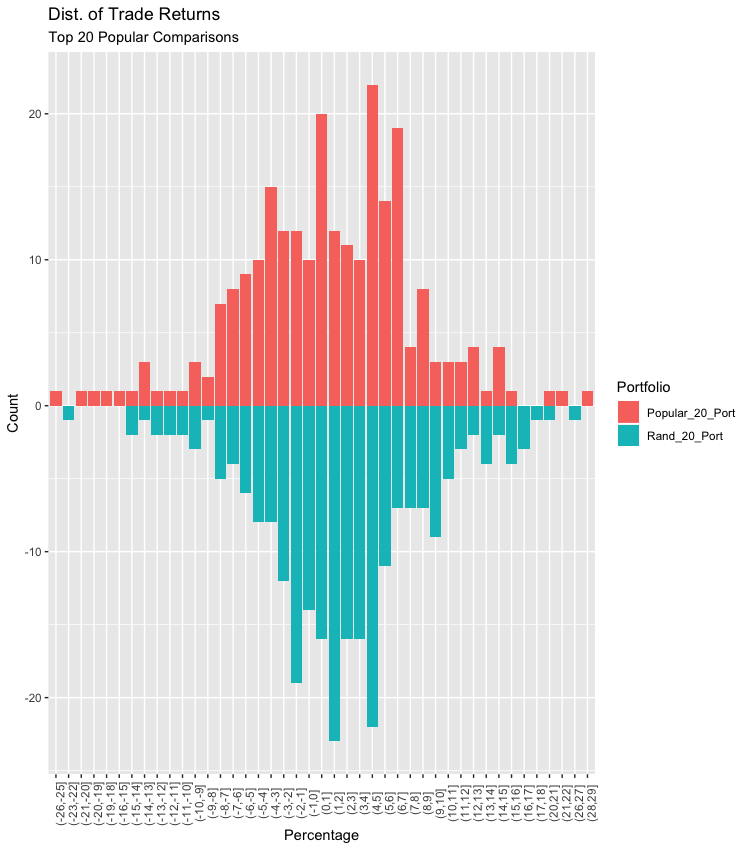

Let’s view the return distribution for EACH trade made on the Full Portfolio and compare that to random samples. Also, we will compare these returns against a basket of the 20 most popular stocks in the NASDAQ as well as 20 random stocks from the top100 ranked by total return. I classified the “20 most popular” names by researching the most widely held stocks in the NASDAQ, most active by dollar trading volume in NASDAQ, and NASDAQ stocks in Robinhood’s top 100 most popular list.

The returns for each trade made seem to be normally distributed, with exception of a few outliers. I removed those to get a cleaner view of the distributions, which we can see the average return for a trade is 46 basis points (or 0.46 percentage points). This is great considering there are over 3500 total trades. What about the overall return or the comparison to popular household names?

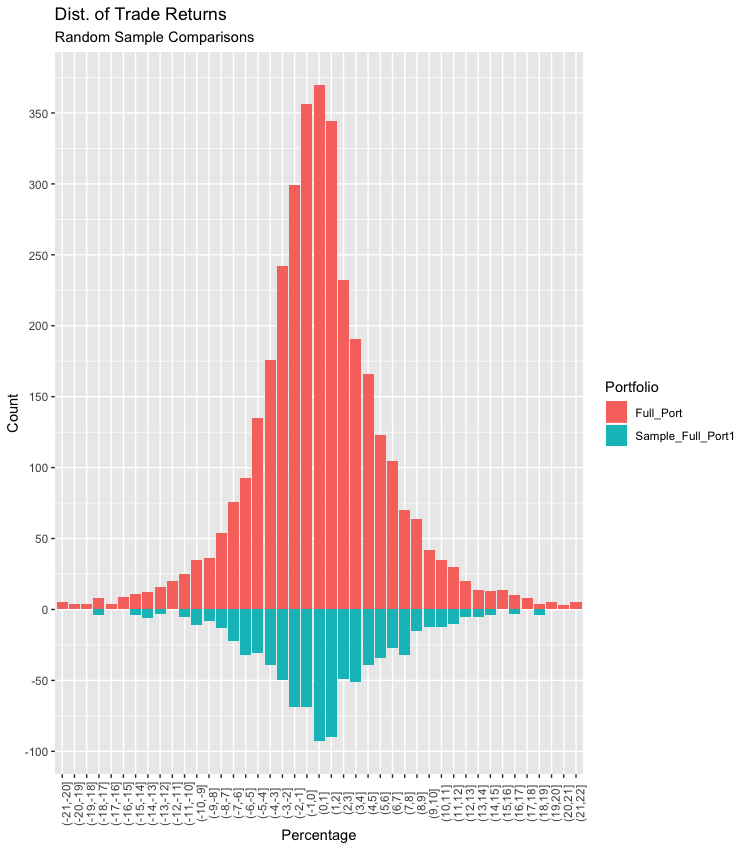

###Our Portfolio vs Sample Portfolios vs Most Popular First, I would like to compare the distribution of the trade returns to the distributions of the randomly selected samples from the Full Portfolio. I’m doing this to gauge how this simple strategy would perform if we were to just randomly select a group of stocks or a group of popular stocks. After, we can compare the overall returns from each portfolio to see how effective this trade is compared to just trading the Top 20 Most Popular household names.

| Portfolio | Median Total Return | Mean Total Return | Avg Return Per Trade(plot) |

|---|---|---|---|

| Full_Port | 4.22% | 5.66% | 0.46% |

| Sample_Full_Port1 | 11.3% | 10.9% | 0.87% |

| Portfolio | Median Total Return | Mean Total Return | Avg Return Per Trade(plot) |

|---|---|---|---|

| Sample_Full_Port1 | 11.3% | 10.9% | 0.87% |

| Sample_Full_Port2 | 6.21% | 6.73% | 0.54% |

| Portfolio | Median Total Return | Mean Total Return | Avg Return Per Trade(plot) |

|---|---|---|---|

| Sample_Full_Port2 | 6.21% | 6.73% | 0.54% |

| Sample_Full_Port3 | 0.045% | 4.92% | 0.40% |

| Portfolio | Median Total Return | Mean Total Return | Avg Return Per Trade(plot) |

|---|---|---|---|

| Sample_Full_Port3 | 0.045% | 4.92% | 0.46% |

| Sample_Full_Port4 | 0.72% | 0.257% | 0.021% |

| Portfolio | Median Total Return | Mean Total Return | Avg Return Per Trade(plot) |

|---|---|---|---|

| Popular_20_Port | 16.1% | 12.6% | 1.04% |

| Random_20_Port | 21% | 28.8% | 2.29% |

Table for the overall gain / loss for each portfolio/sample above

## # A tibble: 7 x 3

## Portfolio MED.RTRN TOT.RTRN

## <chr> <dbl> <dbl>

## 1 Full_Port 4.21 5.66

## 2 Sample_Full_Port1 11.3 10.9

## 3 Sample_Full_Port2 6.21 6.73

## 4 Sample_Full_Port3 0.05 4.92

## 5 Sample_Full_Port4 0.72 0.26

## 6 Most_Popular_20 16.1 12.6

## 7 Random_20_Top100 21.0 28.8###Overall Returns Summary

As we can see, the total return from the start 2016 to Friday 3/8/2019 for the entire portfolio was 5.66%. Not bad for an extremely simple strategy! Although, if you were to use this strategy on the popular household names then you would have done better than using a sophisticated “algo” trader across the entire NASDAQ index. By using this simple buy and sell earnings play across the 20 most popular names in the NASDAQ, you could have returned 12.62% for the same time period. On the other hand, if you can use the computer to your advantage by training it to decide which stocks to run this simple strategy on, then it can greatly increase your returns. By running this simple strategy on 20 random stocks from the top 100, our returns shot up to 28.79% for the same time period.

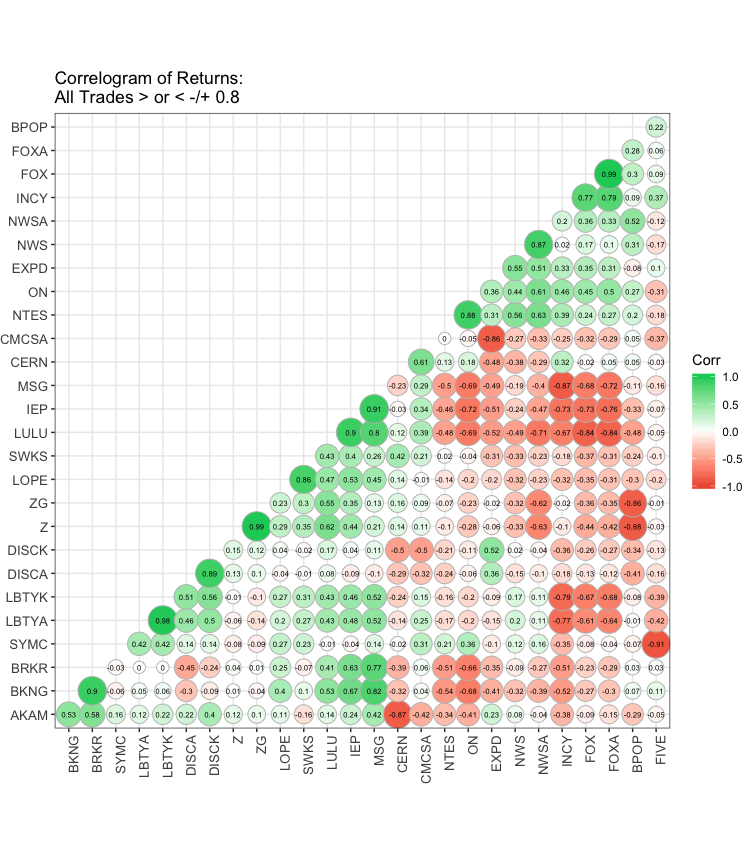

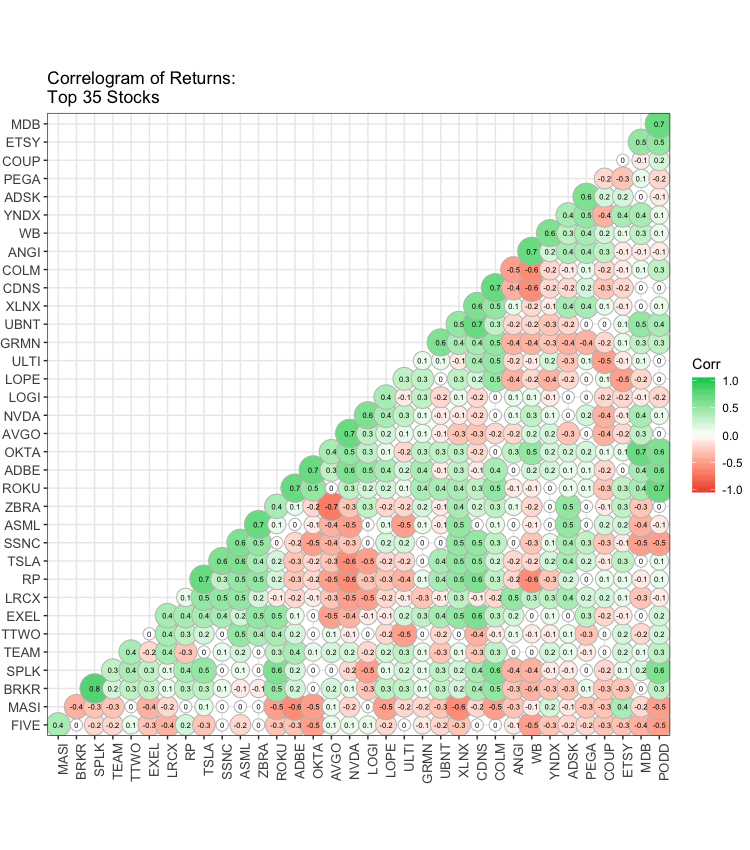

###Quick Look - Correlation Among Returns

Something interesting I thought I could look at was the correlation between the average earning returns for each stock. I’d like to see if any strong correlations above +/- 0.8 exist. If so then that can be something to help us decide which stocks to choose when initiating this simple earnings strategy. We will also do the same for the top 35 stocks.

###What’s Next Overall, I’d like to fine-tune this simple strategy by maybe testing different buy/sell triggers, adding a couple of momentum indicators, getting intraday data, or even adding in a sentiment score going into earnings. I also want to check out what those high correlations are all about and backtest a pair trade strategy. I may create a continuation post to this and test out earnings pair trading strategies.