#Salesforce Q3 Update - Updated model from previous post, click here to read previous Salesforce post - Management raised top and bottom line forecasts for FY19 guidance - Management gave more details on FY20 & FY22 goals and confirmed forecasts - Near bulletproof business model during economic slowdown - Key risks to management goals - Recommendation and price targets

Salesforce (CRM) carried on with its tradition of beating expectations and raising future forecasts in its most recent quarterly results. This provides concrete evidence to investors that management’s long-term forecasts of FY22 revenue are likely to be met. Not only did the company confirm its FY22 goals, but they gave more detail on expectations for FY20 that indicates a 20-21% revenue growth rate which is above expectations of 19% YoY. In my previous valuation for Salesforce, I was a bit conservative regarding the forecasts that executives continued to tout in previous earnings calls and investor presentations. I was not doubting the guidance management was laying out, but I was a bit worried about competition from its peer’s such as Workday (WDAY), Adobe (ADBE), Oracle (ORCL), ServiceNow (NOW), Microsoft (MSFT) and others. The guidance on the most recent quarter has taken care of any doubts I previously had, so I took off some constraints to my estimates.

#CRM Segment & CEO Marc Benioff It is understood that Salesforce is considered a growth stock so when we see market meltdowns, growth stocks see contractions to their valuation resulting in a decline in share price. Salesforce was trading at $130.40 as of today’s close (1/3/2019), 19.1% off from its 52 week high while at one point reaching 29.52% off its high’s. This show’s how a growth stock can be risky during a time of market turbulence, but Salesforce is not just any other growth stock. It is true that during a recession, most companies begin to reduce workforce and cut cost’s in order to stay competitive in a recession environment. In order to stay competitive in today’s business landscape, you need to stay focused on your customers and make sure the customer experience doesn’t fall to the point where they begin to look for other solutions. I believe Salesforce has a near bulletproof business model during these slowdowns for two reasons. First reason, Salesforce has that exact solution for companies that are looking to cut costs but keep customer experience above par. Companies are able to use Salesforce software and cloud solutions to cut certain overhead costs, improving customer experience to drive growth. See below for the CEO’s view on the Customer Relationship Management segment.

“And CRM has never been more strategic. You could see that in the growth rates for the CRM marketplace. It remains the fastest growing market segment in enterprise software… Now, it’s all about the customer, it’s about CRM. And this is a big and exciting market. We’re obviously largest player, we have these incredible growth rates that we’re putting up. When we look at other companies in the CRM marketplace, a lot of companies are doing very well, because this is what it’s all about; it’s all about the customer. And Salesforce remains this global CRM leader. We’re the number one CRM. We continue to take share and outpace the market.”

#The Numbers Unsurprisingly, Salesforce raised guidance on multiple fronts. For the first time Salesforce gave us detail on FY20 numbers, which put YoY revenue growth above expectations. Analyst were expecting 19% YoY growth on $15.83 Billion in revenue, but guidance came in at 20-21% YoY growth on $15.9-16.0 Billion. FY19 revenue was confirmed at $13.23 billion to $13.24 billion which implies a impressive 26% YoY growth rate. Salesforce not only blew expectations out the water by beating non-GAAP EPS consensus by 22% reporting $0.61 vs $0.50, but also raised FY19 non-GAAP EPS to $2.60 to $2.61 from $2.50 to $2.52. As for FY22, the goal of $21-23 Billion was confirmed once again but something interesting to note is how CEO Marc Benioff spoke about it on the conference call (see below).

“Obviously, we’ve given guidance for an incredible fourth quarter coming. And I’m hoping that Keith is going to improve on that even though the fourth quarter guidance is incredible. And here we are $16 billion for next year and only two years from our goal of $22 billion to $23 billion, which is amazing that in fiscal year ‘22 we have this vision.”

He completely left out the bottom range of the companies future guidance possibly indicating that they will hit on the higher end of expectations.

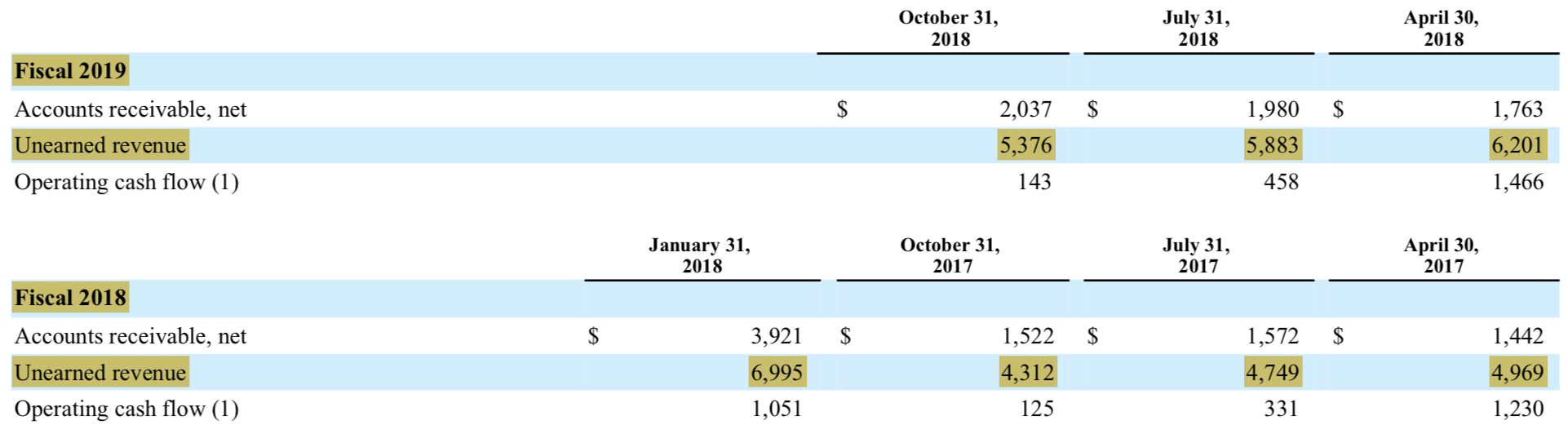

#Risks to Management Long-term Goals As with any long-term goals, there is risks associated with it. I will not go into too much detail but rather highlight key risks investors should watch for. One is the upcoming and final Unearned Revenue guidance. The company will discontinue providing guidance for UR, but investor’s should want to see YoY Q4 growth in UR as this is the quarter big enterprise clients renew contracts and add subscriptions.

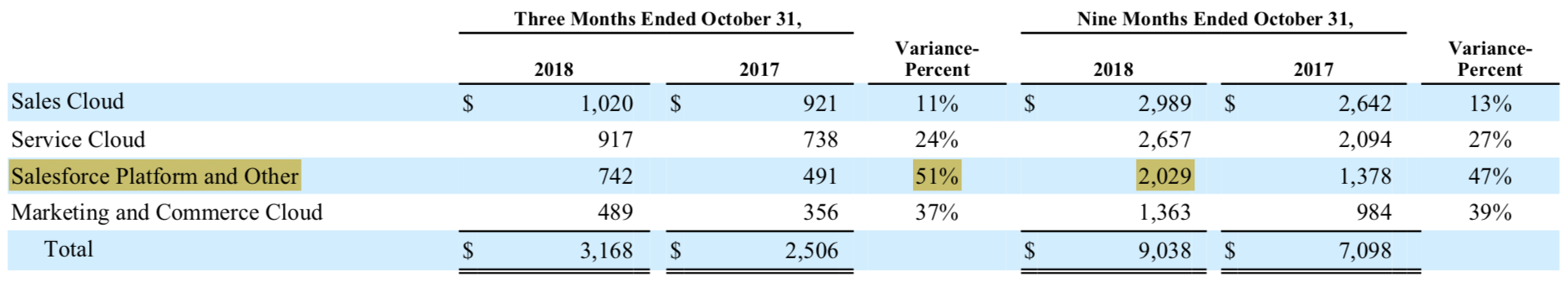

FY18 Q3 to Q4 UR grew 62.2% from $4.312 to $6.995 Billion. FY19 Q3 UR is currently at $5.376 Billion and management is expecting a quarterly growth rate of 52% which implies a Q4 YoY growth rate of 17%. This will bring UR in FY19 at around $8.1 to $8.2 Billion. Watch for any shortfalls to this number as it could potentially signal a miss in FY20 revenue growth. Another risk is that the $6.5 Billion acquisition of Mulesoft doesn’t realize all the growth and benefits. Salesforce has a net debt position of -$228 Million due to the large acquisition and must generate growth. Although the Mulesoft acquisition is helping Revenue segments like “Salesforce Platform and Other” grow rapidly due to the strategic integration, only 10% of the $2.029 Billion in revenue was attributed to Mulesoft. Investor’s should pay attention and watch how the Mulesoft integration affects top and bottom line.

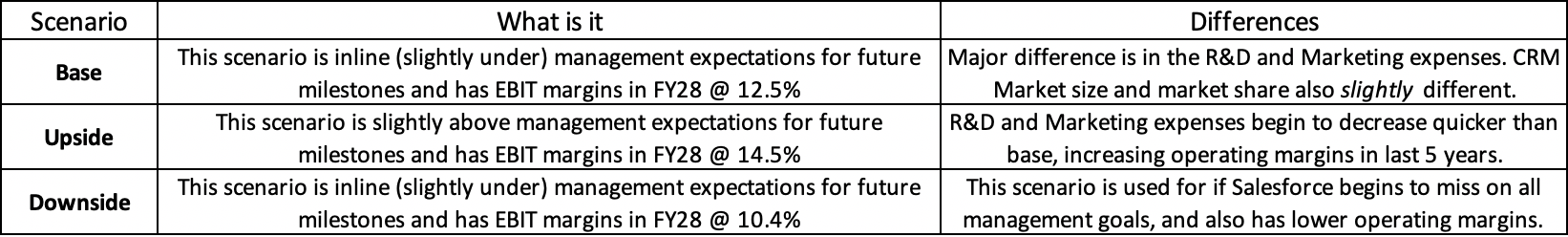

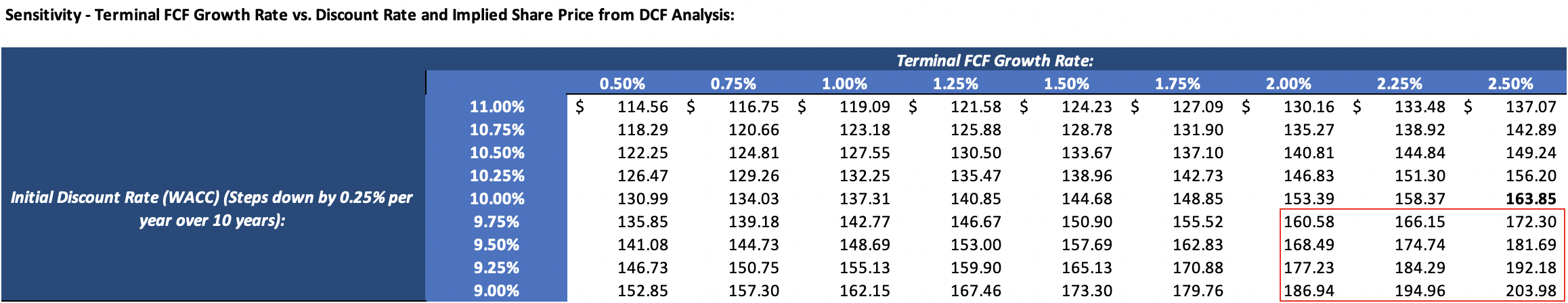

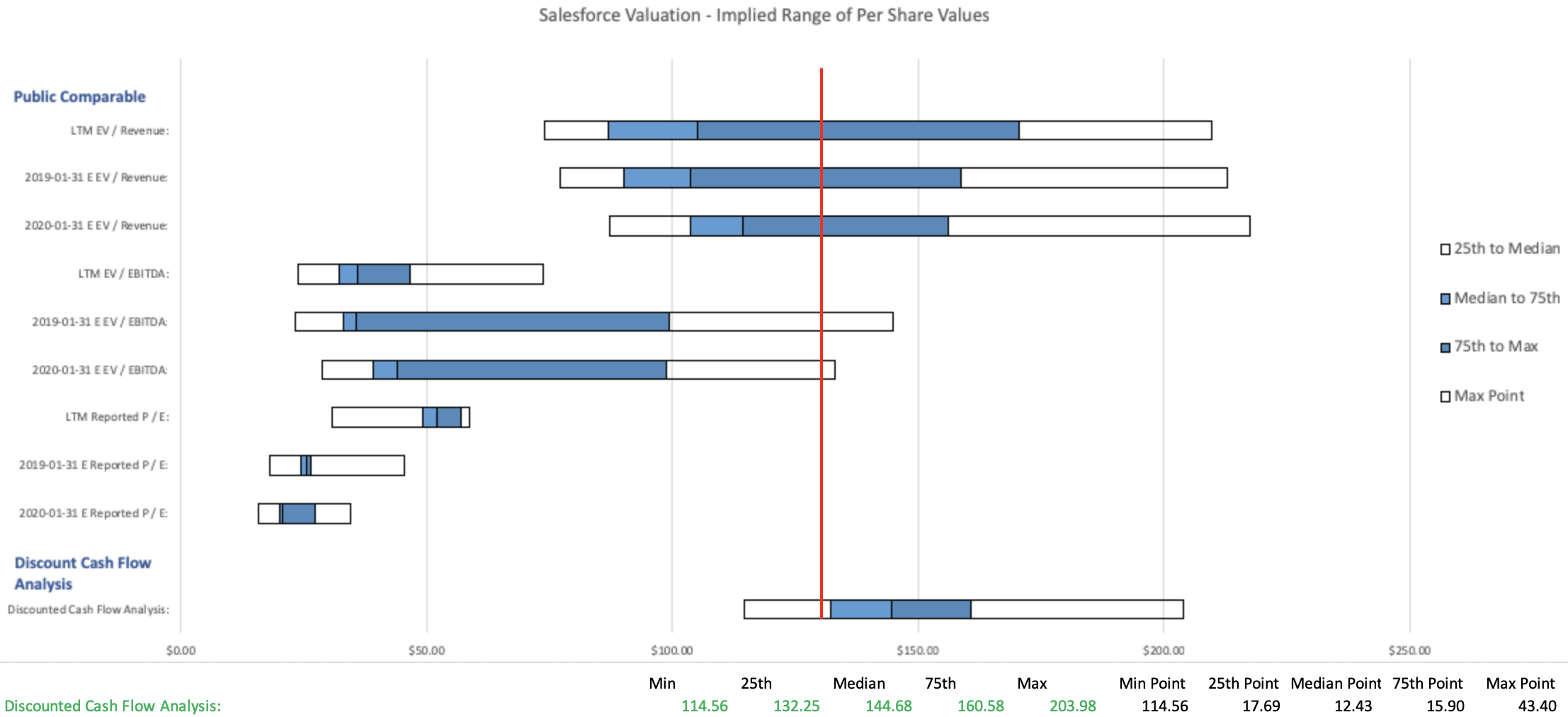

#Updating the Model As I stated in my previous post, I believe the base & upside case should be used for this stock. Since I had my doubts regarding peer competition and optimistic long-term goals, my previous base case was a bit constrained falling under what management was forecasting. I considered the upside case to be slightly above the guidance management gave for FY22. After giving less constraint to my model and plugging in the newly released numbers, the base price target of $140 is up from my previous estimate of $119. My upside scenario has a price target of $164 which is up from my previous estimate of $149. Salesforce last traded at $130.4 and can be considered undervalued under both scenarios with the base implying a 7.36% discount and upside implying a 25.77% discount. For a little more detail on Base, Upside, and Downside, see below. You can also find the sensitivity and football field valuation tables below for possible levels if price target is breached.

#####Base vs. Upside vs. Downside

#####Sensitivity Table - Upside

#####Football Valuation Field - Upside

#Recommendation If you are a current shareholder that is neutral weight on your position, then my recommendation is to HOLD. Possible market rotations into value names could allow us to get a better price. Although if you don’t own a leading SaaS and CRM company such as Salesforce, then my recommendation is to BUY a neutral weight position as the recent sell-off provided a decent opportunity to get into this competitive growth company.