#Salesforce, Inc. - Leader in the growing CRM market - Modestly expanding margins - Monetizing existing customer base

###Customer Relationship Management Pioneer Whenever Customer Relationship Management is the topic of discussion, it’s almost impossible not to see Salesforce mentioned as the pioneer and leader. Salesforce currently has the largest market share of the CRM segment and is expected to continue gaining market share. Before we dig in to Salesforce specifically, let’s explore what exactly CRM is and the growth prospects. I love getting into detail, but I will try my best not to go too far into it. I want to cover some important factors that can affect Salesforce future cash flows instead of specific steps and calculations.

###Convenience Factor - What is it? CRM falls under what I like to call the Convenience factor. These are companies that truly help make running a business extremely efficient, reduce workloads, costs, automating repetitive tasks such as database maintenance for enterprises and small businesses, ease of use, etc. which gives these enterprises, businesses or consumers the freedom to focus on the true scope of the project or task. Looking at an example in the simplest form, imagine you come from a fashion background and decide to open a website to begin selling your successful clothing line within the next week. You want to save the hassle and money, so searching for a website developer to hire can be a lengthy and expensive process. Lucky for you, the “convenience factor” comes into play and you can use a website building software such as Wix. Wix allows anyone from any background to build and run a user friendly website. If you were truly dedicated, you could build your own website and launch it the same day for a fraction of the cost and time spent. It comes with no surprise that a “convenience factor” company like Wix have generated large returns for investors in recent years.

###What exactly is CRM Considering the amount of data needed for these “Convenience” companies, it is no surprise that most are considered to be within the enterprise cloud industry. CRM should help and improve the relationship your business has with its existing customers, while finding new ways to win back existing and new customers. This software incorporates the collection, organization, and management of the customers information that gives you advantages, such as how to interact with customers giving them a person feeling. For large companies with millions of customers, or for new / small companies that want to enhance customer acquisition, this kind of technology can be extremely beneficial. This software also is useful to identify potential new customers and increase existing customer revenue. CRM systems also help decrease turnaround time for customer inquiries by developing better and effective communication channels. This makes call centers much more efficient, enhances customer loyalty, and allows effective communication between all departments of the company. This leads to more profitability and efficient time use since staff no longer have to leave their desk to search for information from other departments since all customer data is shared remotely. Most importantly, CRM can optimize your business marketing by showing customer needs and behavior. This can help identify correct times to market products, which customer groups to market certain products to, which customers are most likely to buy high margin products, etc. If a customer loads up a shopping cart online but does not check out, CRM can even track advertisements to convince you to checkout some items in your cart. I think the CRM market is just getting started as more and more businesses are learning the benefits of this software. As long as businesses desire to retain existing customers, gain new customers, and build a competitive advantage then the CRM industry should outperform.

###Salesforce - The Company Salesforce was founded 19 years ago, and has since been a pioneer and leader in this specific segment, CRM. Most of Salesforce products are supported by their main Salesforce Platform and Salesforce Einstein, which delivers AI-driven recommendations and insights across the Marketing Cloud. Approximately 93% of their total fiscal 2018 revenue was from their subscription based cloud platforms, and the other 7% was from Professional Services and other. These products include Sales cloud, Service cloud, Marketing and Commerce cloud, and the Salesforce platform. Professional Services are a result from training how to use its different forms of software. Let’s jump right into the statements starting with the top line growth. We see a 5-year revenue growth of 157.43%, compounded at 20.82% annually. This compares to the CRM segment 5-year growth of 97.41%, compounded at 14.57% annually. I compared with the CRM market because they has been their prior business the last 5 years. Salesforce has announced in 2018 that they are in “execution mode” on its long term vision. This vision involves a multi-cloud customer execution that involves monetizing the existing customer base. The CFO, Mark Hawkins, stated that

“This is 100% of all the paying customers we have, all 150,000-plus paying customers. And 38% of them are multicloud, which tells me a very encouraging bit of news, which means that 62% are not. And the reason that’s particularly encouraging is when you go to multicloud, you spend 10x as much. This will power durable growth for years to come.”

Salesforce currently has the most complete portfolio of product offerings in the industry. If Salesforce can continue to monetize on their existing customers while gaining new customers, I believe that Salesforce can achieve the goals that management has in their long-term scope. This includes a fiscal 2022 revenue of $21-23 Billion, and a total addressable market of $140 Billion. To show how much multi-cloud customers can impact the top line, 92% of revenue came from multi-cloud customers. My operating margins in the model show a modest expansion, with the upside showing the most. My assumption is that Salesforce will need to grow their operating expenses inline with revenue in order to fulfill their long-term vision of converting more customers to multi-cloud users. My base assumption shows operating margins growing 13.42% annually from 2.25% to 7.92%. In the upside, operating margin shows a annual compounded growth of 14.77% finishing fiscal 2028 at 8.92%, and the downside shows 12.17% and 7.09% respectively. I believe these are modest assumptions and can be adjusted if more detail is given their long-term vision on how they are going to monetize their existing customers.

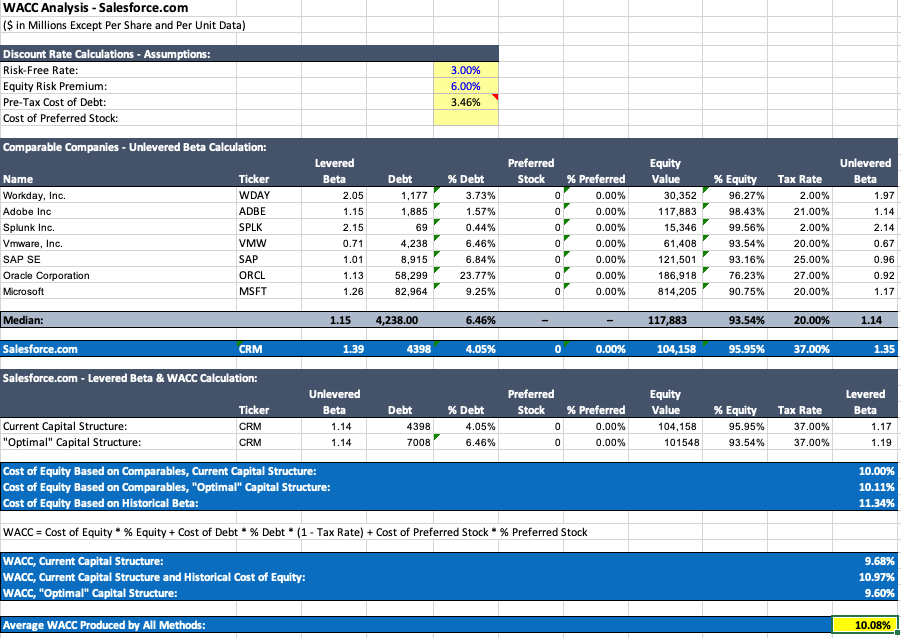

###WACC and Comparable Analysis

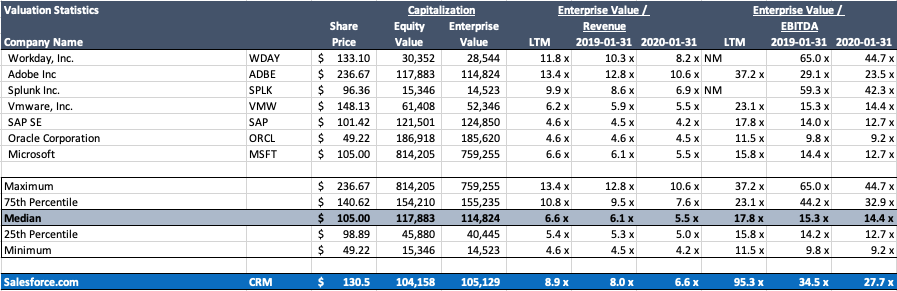

The comparables I used for this model were 7 companies that are also dominant players in the CRM and Enterprise cloud segment. These companies are Workday (WDAY), Adobe (ADBE), Splunk (SPLK), Vmware (VMW), SAP (SAP), Oracle (ORCL), and Microsoft (MSFT). I used S&P Capital IQ to screen and gather these comparables, looking at industry, market cap, and revenue’s. After conducting in-depth comparable analysis, I was able to use the comparable data for Salesforce. See below for a screenshot of comparable valuation statistics and calculations for WACC. I will not go into detail on any of the calculations used, but if your interested in how and why I calculated something, feel free to reach out and ask.

WACC Assumption

I assume that Salesforce will not remain as risky as it is today as the business matures, so I started fiscal 2019 with a WACC of 10% (right under the optimal average) and remaining their until fiscal 2022. My reasoning is that I want to see if management can deliver on their 2022 vision before deciding to reduce the discount rate. From there, it decreases 50 basis point per year until fiscal 2025, which then decreases by 25 basis points finishing fiscal 2028 at a WACC of 7.75%. I used a final WACC terminal value discount rate of 7.5%.

###Comparable Analysis highlights

The comparable analysis took me about 4 hours to complete, and this screenshot is just a small outcome from the data. I went through each 10-k and 10-q of each comparable company, searched and calculated any dilution, and gathered a mixture of operating statistics and valuation statistics. This allowed me to calculate the max, 75th quartile, median, and 25th quartile, and minimum of all comparables. We can now get a sense of what the market is trying to value Salesforce compared to its peers. The median projected revenue growth for its comparables are 10.6% while Salesforce estimates 20.1% revenue growth for fiscal 2019. Our EBITDA growth does not compare with the comparables, as Salesforce has a projected EBITDA growth of 176% while the max for its comparables is at 45.3%. Despite the fast growth in EBITDA, we see the EBITDA margin coming in under the 25th percentile mark at 23.1% for fiscal 2019. We can see that the market is putting a rich EV/EBITDA valuation on Salesforce coming in at 34.5x for fiscal 2019, which is about the comparable median of 15.3x but under the 75th quartile of 44.2x. Looking at EV/ Revenue, Salesforce still has a slightly higher valuation than the median for fiscal 2019 coming in at 8x compared to 6.1x. The 75th percentile is at 9.5x. One can argue in the bull-case that since Salesforce is a leader and has shown tremendous repetitive success in CRM, we must believe management will execute its long-term vision, therefore deserving the 75th or even max valuation multiples. I believe this rich valuation is justified since Salesforce is outperforming in top line and EBITDA growth against its peers.

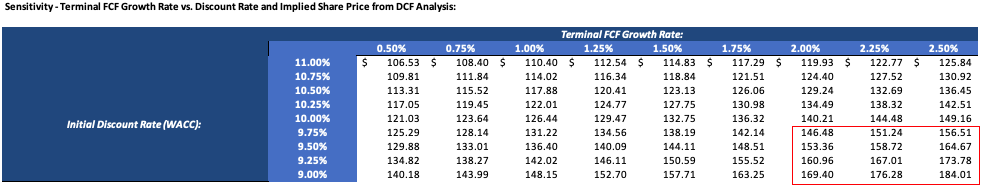

#Conclusion Due to my research and analysis, I am going to assume the Base and Upside case is best suitable to find a appropriate price target for Salesforce. The Base case assumes a terminal growth rate of 2% and has a price target of $119, which at today’s price is currently over valued. If management can execute on their long-term vision of $23 Billion in revenue by 2022 and successfully monetize existing singe-cloud customers to multi-cloud customers, then I believe the upside scenario is most appropriate. My upside scenario has a terminal growth rate of 2.5% and a price target of $149 which at today’s price is undervalued.

- I would like to note and point out that even in this upside scenario, this model was being slightly modest on the growth in operating margin’s due to my assumptions. As a reminder, I assumed operating expenses grew slightly inline with revenues. This is not a bad assumption since management stated in the Q219 10-q, that operating expenses are expected to grow slightly inline with revenues. This can always be adjusted once more detail and data is released on the long-term vision and execution plan.

#Recommendation When giving recommendations, I always use a longer-term view instead of the traditional 12-month forecast most analysts give. I believe any investment held for under 12-months is considered more of a swing-trade than investment. Any investment in a business, should have a longer term view in order to let the business and scope of the management play out. If the fundamentals and growth prospects remain as forecasted but you decide to sell within a 12-month period due to price action, then what was the point of putting in days worth of research and analysis? This is why I do not like to give a short-term trade recommendation, but instead a longer-term investment recommendation.

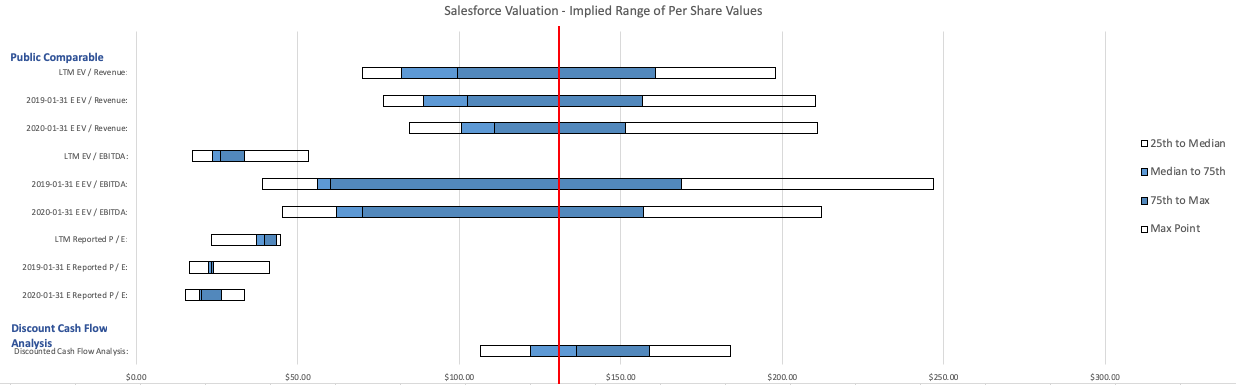

Using the upside valuation for Salesforce, my recommendation is to BUY a neautral weight position while monitoring your investment due diligently. If it hits our Price target of $149/share, we should evaluate the current fundamentals and to check for any updates on the execution plan. I would suggest looking at the sensitivity table below as well as the football field valuation to see the area’s of stock prices that can be expected if our DCF valuation of $149 is breached. The Football field valuation graph also shows relative valuations for Salesforce which was derived from the public comparable analysis.

Sensitivity Table

Football Valuation Field